How to Read Pay Stub Big Law

How To Read a Pay Stub

It'south essential to verify that each of your pay stubs contains your correct name, tax deductions, Social Security number, vacation residuum and pay rate. In addition, you should brand certain your benefits deductions — including your dental and health insurance and 401(k) plan — are accurate so that you can ostend yous're properly enrolled.

Their Impact on Coin: Gen Z: The Future of Finances

Find Out: Do Y'all Know What'south Being Deducted From Your Paycheck?

Although companies print different kinds of paychecks, the police requires they all contain certain information. Pay stub abbreviations can exist confusing, then keep reading to learn how to decipher your pay stub. Bonus: you lot'll too glean valuable information that might aid you improve your coin management.

What Is a Pay Stub?

Your pay stub is the part of a newspaper paycheck that you keep afterward you cash or deposit the cheque. Typical information that appears on your pay stub includes the number of hours you worked during the pay period, the gross and net amounts yous earned, a breakdown of federal and state income taxes y'all paid, whatsoever employment tax and a list of revenue enhancement deductions.

Go along Reading: fifty Mindless Ways Yous're Called-for Through Your Paycheck

How To Read Your Pay Stub

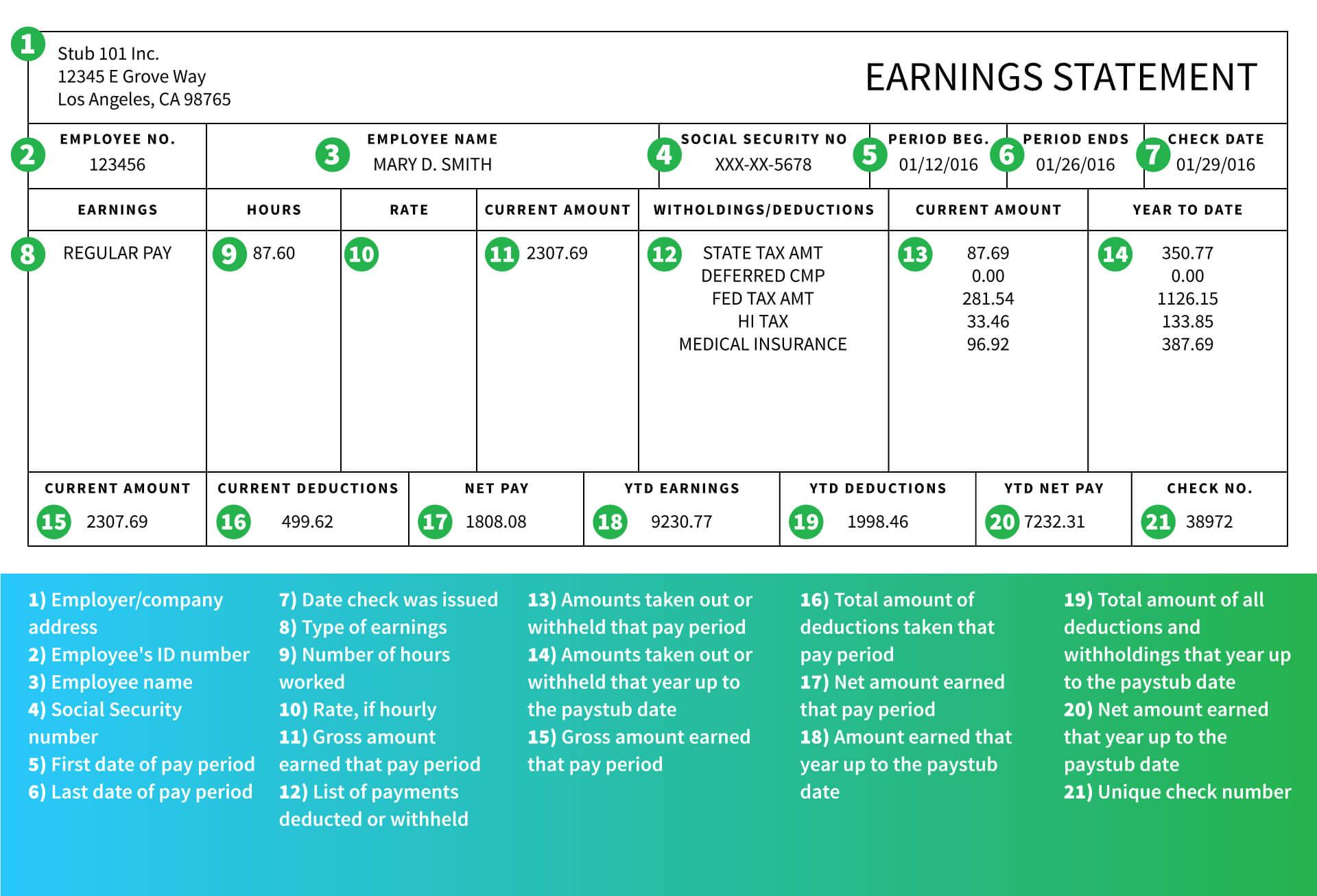

The different numbers on your paycheck might seem mysterious if you don't know what they stand for. Hither'south a full breakdown of a pay stub so you lot tin empathise exactlywhat practise with your paycheck:

- Employer/Company Address: The name and address of your employer

- Employee No.: Your unique ID number at your identify of employment used by payroll managers instead of your total name

- Employee Name: Your name

- Social Security No.: Your Social Security number

- Menstruum Beg.:Date the pay menses began; "Beg." stands for "kickoff"

- Period Ends: Date the pay flow concluded

- Check Date: Date the check was issued

- Earnings: The type of income you lot received, which can include regular pay, overtime pay or other types of wages

- Hours:The number of hours worked during the pay period if y'all are an hourly employee — left blank for salaried employees

- Charge per unit: The hourly rate and number of hours worked if you're an hourly employee, every bit well every bit any bonuses or commissions for the pay menstruation

- Current Amount: Amount you lot've earned during the pay period before withholding and deductions

- Withholding/Deductions: Federal and land taxes taken from your gross earnings for inclusion on your W-2, including Social Security, Medicare and W-2 withholding tax

- Electric current Amount: An itemized list of withholdings and deductions for the pay period

- Year to Date: The period starting from the beginning of the year to the nowadays; the figure represents your itemized deductions during that time menses

- Current Amount: Your gross earnings during the pay period before whatever withholding and deductions have been taken out

- Current Deductions: Amount of deductions — perchance including401(g) or other retirement savings program contributions — taken out during the pay period

- Net Pay: Amount of have-abode pay, or your pay after tax, afterward all deductions have been taken out

- YTD Earnings: Amount of total earnings for the year to appointment, from the first of the calendar twelvemonth upward to and including the pay stub'southward pay period

- YTD Deductions: Amount of your full deductions from the offset of the calendar year up to and including the pay stub's pay period

- YTD Net Pay: Amount of total net pay earnings from the start of the calendar year up to and including the pay stub'southward pay period

- Check Number: The check number for the specific payment

Have a Await: H ow Much Money Gets Taken Out of Paychecks in Every State

Gross Pay vs. Net Pay

You lot might be confused nearly the difference betwixt your gross earnings and net pay. Gross pay is the full corporeality of income yous earned during a pay catamenia, which is typically one month or two weeks. Gross pay doesn't gene in your tax withholdings, similar federal income tax.

Net pay is the amount of take-dwelling house pay you get after all your taxes and withholdings have been deducted, which includes your federal tax deductions. In other words, net pay is the actual amount of money that you deposit in the bank.

Meet: 35 Useless Expenses Yous Need To Slash From Your Upkeep Now

Relieve Paycheck Stubs

If you lot need more aid reading your paycheck stub or if a particular calculation doesn't seem correct, go assist from your HR department. Your pay stub contains important pieces of information and y'all should understand each piece. Information technology'due south also crucial that you check your stub to make sure information technology'south authentic — and let your employer know if there are any mistakes.

Your paycheck stub serves every bit proof of income and government agencies, lenders and landlords ofttimes request them to verify your earnings. A pay stub contains all your income information, so it's a great tool for tracking your salary, the taxes you've paid, insurance premium amounts, bonus information and holiday and overtime pay. Information technology's important to save your pay stubs in case you need them for annihilation that requires income verification.

More than From GOBankingRates

- Fourth Stimulus Checks Are Coming From These States — Is Yours on the List?

- x Reasons You lot Should Claim Social Security Early

- What Is the Next Big Cryptocurrency To Explode in 2021?

- When Social Security Runs Out: What the Program Will Expect Like in 2035

Bank check Out Our Complimentary Newsletters!

Every day, get fresh ideas on how to salve and brand money and achieve your financial goals.

Source: https://www.gobankingrates.com/money/jobs/money-goes-read-pay-stub/

0 Response to "How to Read Pay Stub Big Law"

Enviar um comentário